Invoicing in Malaysia

For a considerable period, businesses in Malaysia have employed various methods to manage their invoicing and accounting (not knowing anything about MyInvois Integration). Some businesses rely on manual processes involving paper-based invoices and spreadsheets, while others utilize on-premise invoicing and accounting software. Manual invoicing and accounting prove to be time-consuming and error-prone. Moreover, Keeping track of sent and received invoices in accordance with IRBM becomes challenging, and generating accurate monthly and yearly financial reports becomes a daunting task.

To address the challenges inherent in manual invoicing procedures, the Inland Revenue Board of Malaysia (HASIL) has taken the initiative to introduce MyInvois. MyInvois is a cloud-based digital invoicing system developed by the Malaysian government, aimed at facilitating the issuance and receipt of invoices in electronic format. However, it’s worth noting that MyInvois has not been implemented yet and is expected to be launched by 1st of July, 2025.

Approaches for Dealing with MyInvois

1. Manually Uploading Invoices to the MyInvois Portal:

Manual submission of invoices is a common & straightforward method. However, it can be time-consuming, especially for processing a large number of invoices. To manually upload an invoice to MyInvois, follow these steps:

- Visit the MyInvois website and log in to your account.

- Click on the “Invoices” tab.

- Select “Add New Invoice.”

- Choose the “Manual Upload” option.

- Browse for the invoice file you wish to upload.

- Click the “Upload” button.

Once the invoice is uploaded, MyInvois will automatically extract relevant information, such as the invoice number, date, amount, and vendor, which can be reviewed and edited as needed.

Challenges businesses face when manually uploading invoices to the MyInvois portal:

- Data Entry Errors

- Missing Invoices

- Time Delays

- Inefficiency

2. MyInvois Integration (API):

- An API comprises a set of programming instructions facilitating direct data exchange between the taxpayers’ system and the MyInvois system.

- Also, Implementation involves an initial investment in technology and adjustments to the existing systems of taxpayers.

- Most suitable for large taxpayers or businesses with substantial transaction volumes.

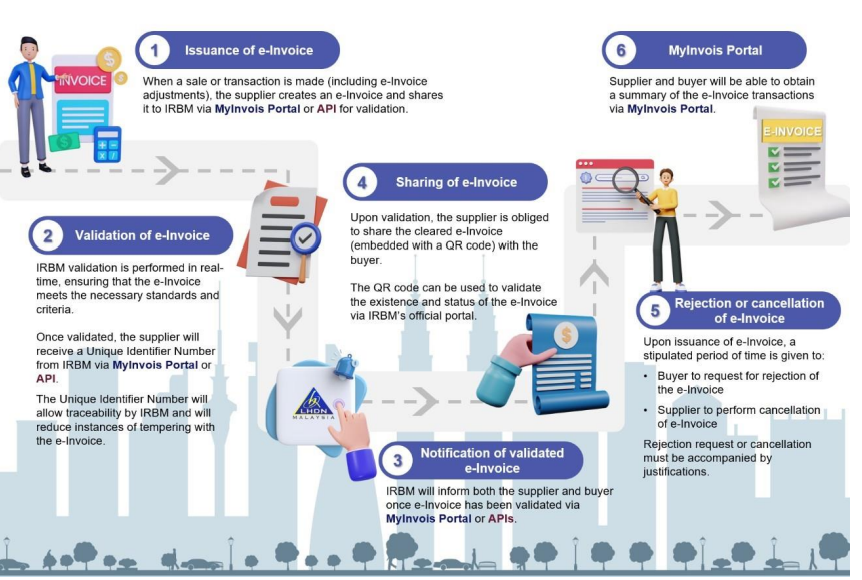

The diagram below provides an overview of the e-Invoice workflow, starting from a sale or transaction initiation, where a supplier issues an e-Invoice through the MyInvois Portal or API. The process further extends to storing validated e-Invoices on IRBM’s database, allowing taxpayers to access their respective historical e-Invoices.

Step By Step Guide to MyInvois Integration

Syslab recognizes the significant advantages of API, particularly in comparison to manual upload methods. Because of the efficiency and convenience offered by API integration, it becomes a superior choice. Given that a majority of Malaysian businesses rely on online accounting software for their financial management, Syslab tailors its integration services to meet the specific needs of these businesses for seamless integration with MyInvois.

Our current offerings include integration with popular accounting software such as;

- Xero

- SQL Accounting Software.

It’s worth noting that Syslab goes beyond standard integrations and so is capable of providing standalone custom solutions that are intricately integrated with MyInvois. Syslab also offers a versatile range of options to suit diverse business requirements.

Benefits of MyInvois Integration in Malaysia

- Reduced Manual Data Entry: MyInvois Integration automates data transfer between MyInvois and other business applications, eliminating the need for manual data entry. This not only saves businesses significant time but also reduces the risk of errors.

- Improved Efficiency and Accuracy: MyInvois Integration streamlines invoicing and accounting workflows, thus enhancing efficiency and accuracy. This can also result in improved cash flow and profitability.

- Real-time Visibility: MyInvois Integration offers real-time access to financial data, aiding businesses in making informed decisions and early problem identification.

- Compliance: Lastly, MyInvois Integration assists businesses in complying with the Malaysian government’s e-invoicing regulations.

MyInvois Integration is supported by several leading e-invoicing providers in Malaysia, including IRIS, Xero, and QuickBooks. This flexibility allows businesses to choose the integration solution that further aligns with their specific needs and requirements.

Syslab Technologies offers a range of MyInvois integration services:

- Direct API Integration: Enables businesses to integrate MyInvois with their other applications directly, utilizing their respective APIs, offering the most flexibility and customization options.

- Third-Party Integration Tools: Allows businesses to integrate MyInvois with other applications using third-party integration tools, which are typically easier and faster to implement but may have fewer customization options compared to direct API integration.

Syslab Technologies: Top MyInvois Integration Providers in Malaysia

Syslab Technologies stands out for:

- Experience and Expertise

- Flexibility and Customization

- Proven Track Record

- Local Knowledge

In Conclusion:

MyInvois is set to revolutionize the way Malaysian businesses handle invoicing procedures, as well as offering a user-friendly, affordable, and seamlessly integrate-able cloud-based invoicing and accounting solution. Consequently, MyInvois Integration promises to have a positive impact on businesses in Malaysia by automating invoicing and accounting workflows, streamlining operations, and enhancing efficiency.

Syslab Technologies Sdn Bhd takes the lead as a top provider of MyInvois integration services in Malaysia. Because of our expertise in MyInvois and deep understanding of the Malaysian business landscape, Syslab Technologies sdn bhd offers customized and effective integration solutions. For more information regarding MyInvois Integration in Malaysia. feel free to contact us.