In today’s digital-first economy, businesses are moving rapidly towards automation, accuracy, and compliance. One crucial part of this transformation is the shift from traditional paper-based invoicing to electronic invoicing (e-invoicing). But while e-invoicing is gaining traction, many businesses are still unsure about the electronic invoice format, how it works, and why it matters.

If your organization is planning to adopt e-invoicing or integrate it with existing systems, understanding the structure and purpose of an electronic invoice format is essential.

What is an Electronic Invoice Format?

An electronic invoice format refers to the structured digital layout used to generate, exchange, and process invoices electronically. Unlike PDF or scanned copies, these formats are machine-readable and standardized to ensure seamless integration between different accounting and ERP systems.

Electronic invoices are not just digital copies of paper invoices—they are data files built for automation, validation, and real-time processing.

Why Format Matters in E-Invoicing

The format plays a vital role in how invoices are transmitted and interpreted. A well-structured format ensures that the invoice can be easily read by other systems without the need for manual entry or conversion.

Key benefits include:

- ✅ Automation: Reduces human error by removing the need for manual data input

- ✅ Compliance: Meets regulatory standards such as MyInvois in Malaysia or PEPPOL in international markets

- ✅ Faster Processing: Enables quicker invoice approvals and payments

- ✅ Data Accuracy: Ensures consistency in tax calculations, totals, and itemization

- ✅ Seamless Integration: Works smoothly with your existing ERP, CRM, or accounting tools

Common Types of Electronic Invoice Formats

Several standardized formats are widely used in e-invoicing across different industries and countries. Here are some of the most common:

1. XML (Extensible Markup Language)

XML is the most widely used format in electronic invoicing. It provides a structured, tag-based format that allows machines to interpret invoice data accurately.

Best for: Government compliance, B2B invoicing, and system integration.

2. UBL (Universal Business Language)

UBL is a subset of XML developed for international trade. It standardizes how invoice fields such as buyer info, tax amounts, and product details are defined.

Best for: Cross-border invoicing and standardized supply chains.

3. JSON (JavaScript Object Notation)

JSON is lightweight and faster to process than XML. It’s often used in cloud-based invoicing systems and API integrations.

Best for: Web-based ERP platforms and real-time applications.

4. EDIFACT (Electronic Data Interchange for Administration, Commerce, and Transport)

This is an international EDI standard used primarily in logistics, transportation, and large enterprise networks.

Best for: High-volume invoice exchanges between trading partners.

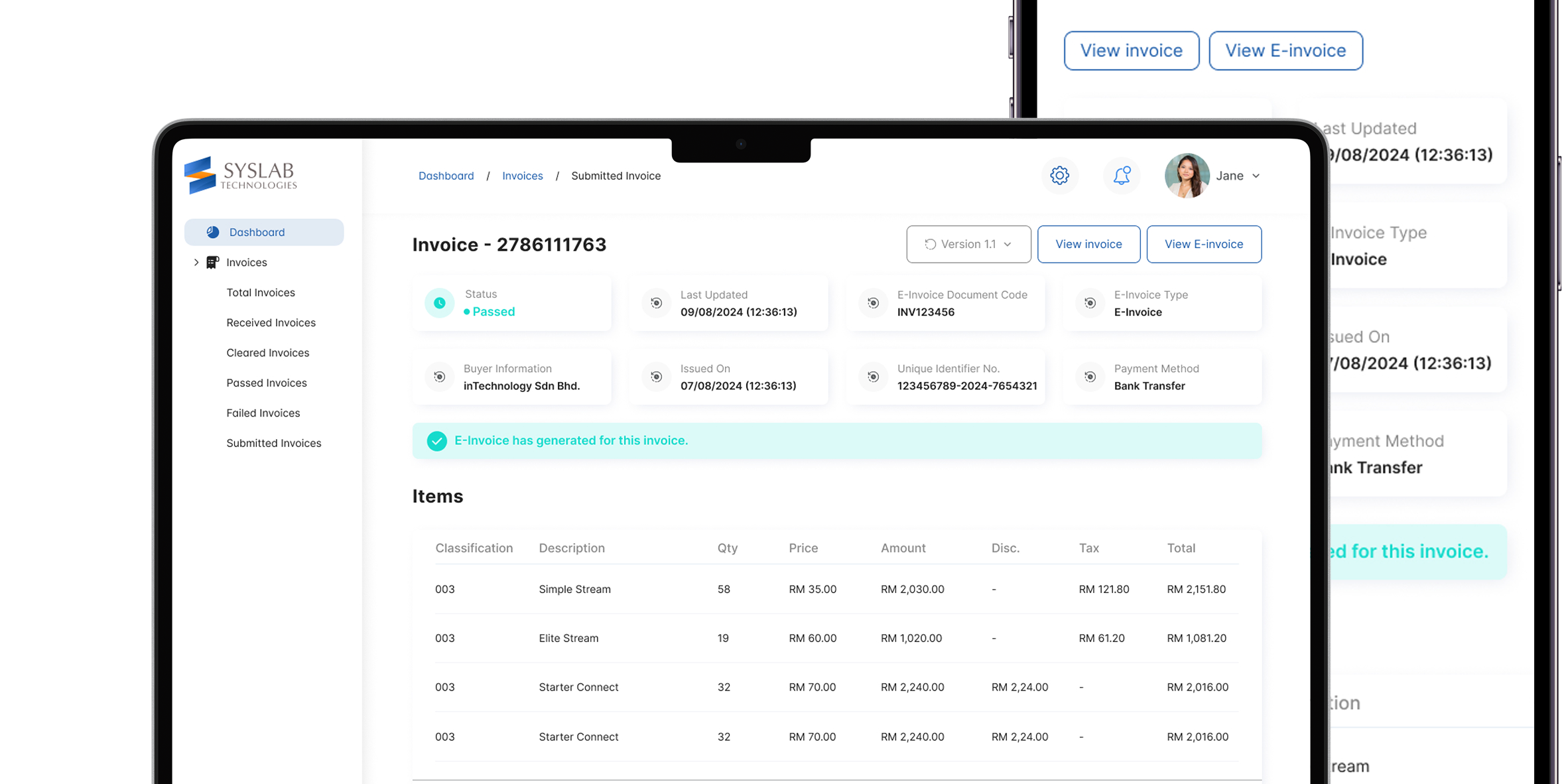

Essential Fields in a Standard Electronic Invoice Format

Regardless of the technical structure (XML, UBL, etc.), most electronic invoice formats include a set of core data elements:

| Field | Purpose |

|---|---|

| Invoice Number | Unique identifier for the invoice |

| Invoice Date | When the invoice was issued |

| Supplier & Buyer Info | Company names, addresses, tax IDs |

| Description of Goods/Services | Itemized list with quantity, unit price |

| Total Amount | Including subtotal, taxes, and final total |

| Tax Information | GST, SST, or VAT details |

| Payment Terms | Due date and accepted payment methods |

These fields are required to meet both legal and operational needs, especially in countries with e-invoicing mandates.

Electronic Invoice Format in Malaysia: MyInvois Framework

In Malaysia, the government is implementing the MyInvois system under the e-Invoicing initiative led by the Inland Revenue Board (LHDN). The initiative aims to improve tax compliance and reduce manual errors.

The MyInvois electronic invoice format is expected to follow a structured XML or JSON layout, including:

- Tax Identification Numbers (TIN)

- Business registration numbers

- Digital signature or authentication data

- Automated submission to LHDN’s platform

Businesses should ensure their accounting systems are compatible with this format to remain compliant with upcoming regulatory requirements.

Integrating Electronic Invoice Format with ERP Systems

One of the major advantages of standardized invoice formats is their ability to integrate directly into ERP software. Whether you’re using a custom ERP or a commercial solution, the e-invoice format can be mapped into your workflows to support:

- Auto-generation of tax-compliant invoices

- Real-time data sharing between departments

- Direct submission to government portals

- Integration with suppliers and clients for faster reconciliation

Working with a technology partner that understands both ERP systems and e-invoicing standards is key to achieving a smooth implementation.

Who Should Adopt a Structured E-Invoice Format?

Structured electronic invoice formats are valuable for:

- Large enterprises dealing with high volumes of transactions

- SMEs looking to streamline operations and reduce overhead

- Exporters/importers managing international trade compliance

- Service providers handling recurring billing and subscriptions

- Government contractors required to follow e-invoicing mandates

If your business handles multiple transactions monthly and needs accurate, automated, and trackable billing processes, adopting a standardized electronic invoice format is not just beneficial—it’s essential.

Frequently Asked Questions (FAQs)

1. What is the difference between a PDF invoice and an electronic invoice?

A PDF invoice is a visual representation, often created manually or exported from software. An electronic invoice is a structured data file (like XML or JSON) that systems can read and process automatically.

2. Do I need special software to use electronic invoice formats?

Yes, your ERP or invoicing software should support structured formats such as XML, UBL, or JSON and integrate with government portals if required.

3. Is e-invoicing mandatory in Malaysia?

The Malaysian government is rolling out the MyInvois e-invoicing system in phases. Businesses are encouraged to prepare early to ensure future compliance.

4. Can I customize the fields in an electronic invoice?

Yes, most electronic invoice formats allow for customization, especially if you are using a custom ERP system that aligns with your business model.

5. How secure is electronic invoicing?

E-invoicing formats can include encryption, digital signatures, and audit trails, making them more secure than traditional paper or email-based invoicing.

Final Thoughts

As digital transformation reshapes business operations, understanding and adopting the right electronic invoice format becomes a strategic advantage. Whether you’re preparing for compliance, enhancing your ERP integration, or simply looking to improve operational efficiency, choosing the right format is the first step toward smarter invoicing.